Annual member statements for the 2024 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2025. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

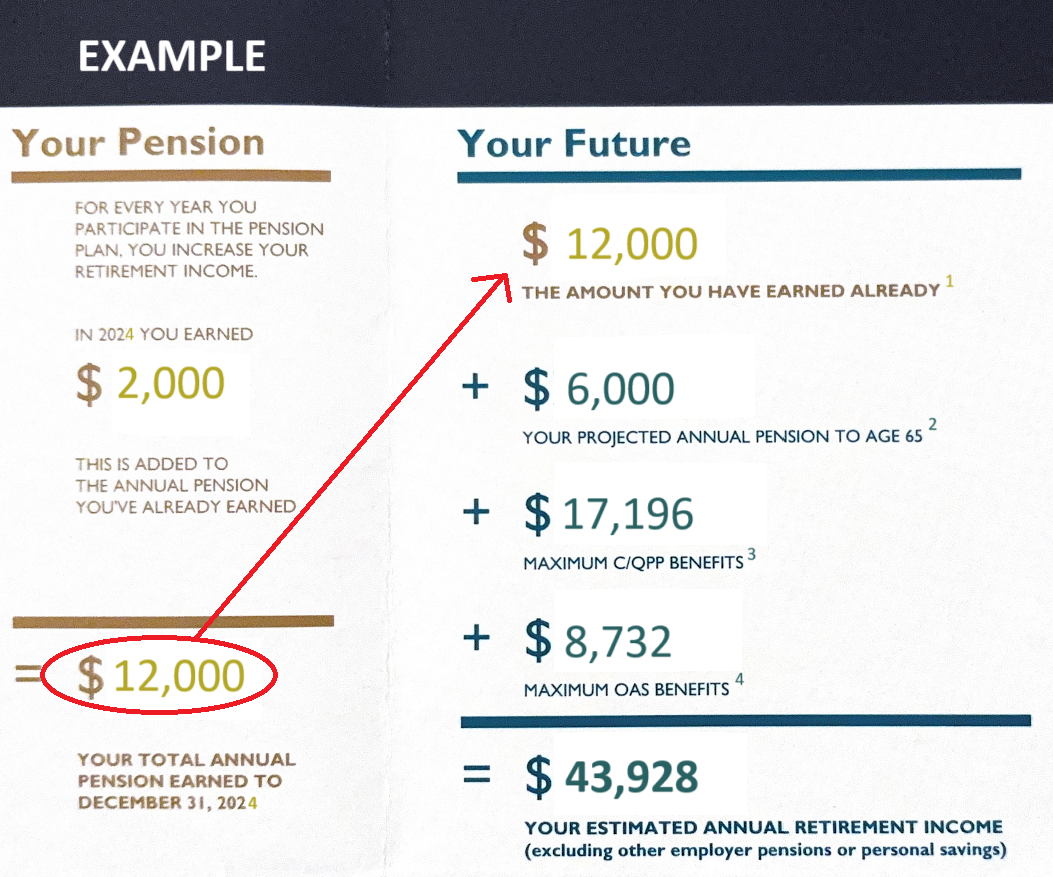

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

1THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

2YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue working in the same job category until you reach age 65. If you stop working before then, or if your pensionable earnings change, this amount will also change.

3MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2025 is $10,796.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

4MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($93,454, for 2025) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

Pension Awareness Day 2025 is on Thursday, February 20, and we are encouraging you to discover the value of a pension. This day is the perfect opportunity to reflect on your retirement planning, stay informed, and take the necessary steps to achieve a more secure financial future for you and your family.

What is Pension Awareness Day?

Pension Awareness Day is a time to raise awareness about the value of pension savings, the many benefits your pension plan offers, and the need to develop a retirement plan as early as possible.

The value of a pension

A pension plan is designed to provide income after retirement, so you won’t have to rely solely on government benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS), which may not be enough to cover all your expenses.

Employees of The United Church of Canada (UCC) who work an average of 14 or more hours per week, contribute to a Defined Benefit plan.

With the rising cost of living and longer life expectancies, government pensions may not be enough to cover all your retirement expenses. In 2024, the average Canada Pension Plan (CPP) benefit at 65 was $805 per month (with a maximum of $1,364.60), and the maximum Old Age Security (OAS) benefit was $725 per month, rising at age 75 to $800 per month.

Tools and Resources

Check out our pension tools and resources to learn more about:

From the Government of Canada:

Join our webinars on ChurchX to delve deep into retirement planning and your pension plan benefits:

Boundaries Refresher: Retiring with Grace (for ministry personnel only)

Monday, February 3, 2025 1:00 – 2:30 pm ET / 10:00 – 11:30pm PT

Click here for the start times in each of Canada’s Time Zones

The United Church of Canada provides a Defined Benefit Pension Plan for all employees who work more than 14 hours a week. Register here for this 90 minute program to learn about how the plan works, what it costs, what it provides, and how to apply for your pension when you're are ready. In this program we'll describe:

If you have any questions, please contact Shenagh Rosa, Manager, Pension Compliance and Communications, at srosa@united-church.ca

Good news! Pension plan members will receive a pension increase effective January 1, 2025. Due to the Canada Post strike, you will receive the letter from Pension Board Chair, Anne Soh, once the strike has been resolved. You can access the letter electronically here:

Pensioners and Deferred Members

Current pensioners and deferred members will receive a 2.7 percent* increase to their pension amount effective January 1, 2025.

* The Income Tax Act and regulations and the Plan, limit pension increases to the cumulative growth in Consumer Price Index since the pension commenced. For this reason, recently retired pensioners and deferred members who terminated active membership recently may see a lesser increase.

Active Members

For active members, the accrual rate will stay at 1.85 percent in 2025, up from the base rate of 1.4 percent. In 2026 the accrual rate is scheduled to return to 1.4 percent.

What Does “Accrual Rate” Mean?

The accrual rate is the rate at which you earn your pension. In 2025, you earn your pension at the rate of 1.85 percent of your pensionable earnings.

How Does This Work?

You earn a piece of pension every year that you work and contribute to the plan—like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year, (for easy figuring). From 2019, that member would earn

|

Year |

Accrual Rate | Formula |

Pension Credit Earned |

|

2019 |

1.4% | 1.4% of $60,000 | $ 840 |

|

2020 |

1.85% | 1.85% of $60,000 | $ 1,110 |

|

2021 |

1.625% | 1.625% of $60,000 |

$ 975 |

| 2022 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2024 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2025 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2026 | 1.4% | 1.4% of $60,000 |

$ 840 |

At the end of your career, the annual pension amounts earned each year will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2025 will continue to benefit you for the rest of your retired life.

What about Future Increases?

There is no automatic indexing in our plan. The Pension Board and Pension Plan Advisory Committee annually assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

You should have received your 2023 Pension Statement in the mail these last few weeks. If you have not received your statement and are paid through ADP, please contact them directly to ensure the address on file is correct, then contact pension@united-church.ca to request a duplicate statement.

You will notice that your beneficiaries are not shown on your Annual Pension Statement. Please read the insert provided with your statement that explains why your beneficiaries are not listed. You can also read it here.

This is a standard practice in a transition to a new system. As part of the portal launch process, we will require all members to update their beneficiary information for both the pension and benefit plans (as applicable). Rest assured, the beneficiary information that you have previously provided is in place until such time as the new tool is live and you have confirmed your existing designation(s) or have designated new beneficiaries.

If you have any further questions, please email pension@united-church.ca.

Annual member statements for the 2023 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2024. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

| Your Pension | Your Future |

| FOR EVERY YEAR YOU PARTICIPATE IN THE PENSION PLAN YOU INCREASE YOUR RETIREMENT INCOME | $XX,XXX

THE AMOUNT YOU HAVE EARNED ALREADY |

| IN 2023, YOU EARNED

$X,XXX THIS IS ADDED TO THE ANNUAL PENSION YOU’VE ALREADY EARNED |

+ XX,XXX

YOUR PROJECTED ANNUAL PENSION TO AGE 65 |

| + 16,375

MAXIMUM C/QPP BENEFITS (in January 2024) |

|

| + 8,560

MAXIMUM OAS BENEFITS (April to June 2024) |

|

| = $XX,XXX

YOUR TOTAL ANNUAL PENSION EARNED TO DECEMBER 31, 2023 |

= $XX,XXX

YOUR ESTIMATED ANNUAL RETIREMENT INCOME (excluding other employer pensions or personal savings) |

THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue to work in the same job category until you reach age 65. If you stop working before that, or if your pensionable earnings change, this amount will also change.

MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2024 is $9,983.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($90,997, for 2024) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

Good news! As announced in a recent letter from Pension Board Chair, Anne Soh, pension plan members will receive a pension increase effective January 1, 2024.

Pensioners and Deferred Members

Current pensioners and deferred members will receive a 4 percent* increase to their pension amount effective January 1, 2024.

* The Income Tax Act and regulations limit pension increases to the cumulative growth in Consumer Price Index since the pension commenced. For this reason, recently retired pensioners and deferred members who terminated membership recently will see a lesser increase.

Active Members

For active members, the accrual rate will stay at 1.85 percent in 2024 from the base rate of 1.4 percent. In 2025 the accrual rate is scheduled to return to 1.4 percent.

What Does “Accrual Rate” Mean?

The accrual rate is the rate at which you earn your pension. In 2024, you earn your pension at the rate of 1.85 percent of your pensionable earnings.

How Does This Work?

You earn a piece of pension every year that you work and contribute to the plan—like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year, (for easy figuring). From 2019, that member would earn

|

Year |

Accrual Rate | Formula |

Pension Credit Earned |

|

2019 |

1.4% | 1.4% of $60,000 | $ 840 |

|

2020 |

1.85% | 1.85% of $60,000 | $ 1,110 |

|

2021 |

1.625% | 1.625% of $60,000 |

$ 975 |

| 2022 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2024 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2025 | 1.4% | 1.4% of $60,000 |

$ 840 |

At the end of your career, the annual pension amounts earned each year will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2024 will continue to benefit you for the rest of your retired life.

What about Future Increases?

There is no automatic indexing of our plan. The Pension Board and Pension Plan Advisory Committee annually assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

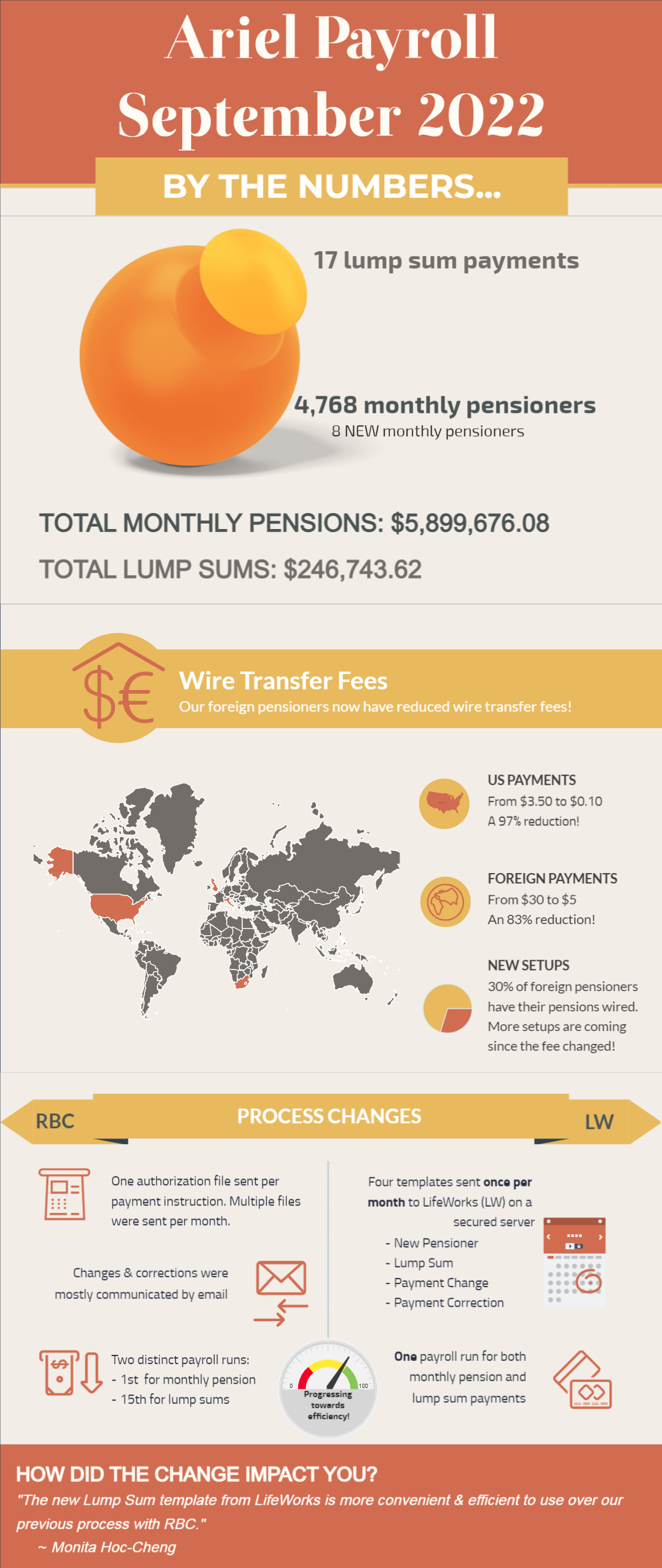

The Benefits Centre team is pleased to announce that we have made 17 lump sum payments and 4,768 regular pension payments following the transition from RBC Investor and Treasury Services to LifeWorks in May. All thanks to LifeWorks' Ariel payroll system that streamlined the payroll run and generated one payroll run instead of two for monthly pensions and lump sums. Check out more details below!

The first letter from the Benefits Centre informing pensioners about the change to the processing of pension payments - from RBC Investor and Treasury Services to LifeWorks.

The second mailing in June was divided into three letters depending on where you are currently residing:

The second communication from the Benefits Centre was mailed the week of June 15, with more information on T4As for the 2022 year, and about the Web portal - which will be available to all in October 2023 but will be optional. Just a reminder, there is nothing for you, as a pensioner, to do on your end.

Three versions of the letter were mailed - depending on your current location - and they are all posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.

First Mailing - First Letter

Second Mailing -

An initial communication from the Benefits Centre was mailed the week of May 23, informing pensioners of the upcoming change to how pension payments are processed. One important thing to note is that there is nothing for you, as a pensioner, to do on your end. More information about the change will be mailed in June providing contact details.

A copy of the letter is posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.