Whether it’s stepping away from your desk, reading a book, or setting healthy boundaries in your personal life, self-care is about showing up for yourself in meaningful ways—big and small. This July, we’re celebrating the importance of self-care and friendship, with two key dates to mark on your calendar:

Caring for your whole self is essential to living your healthiest life. This includes your mental, physical, emotional, spiritual, and practical self-care. Here are some examples – with resources from the GreenShield+ Wellness Hub and WorkHealthLife* – on how you can prioritize you.

*Enter The United Church of Canada to gain access to the site.

Mental Self-Care

Physical Self-Care

Emotional Self-Care

Spiritual Self-Care

Practical Self-Care

This month, let’s commit to nurturing ourselves and those around us, because when we care for ourselves, we’re better equipped to care for others.

Annual member statements for the 2024 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2025. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

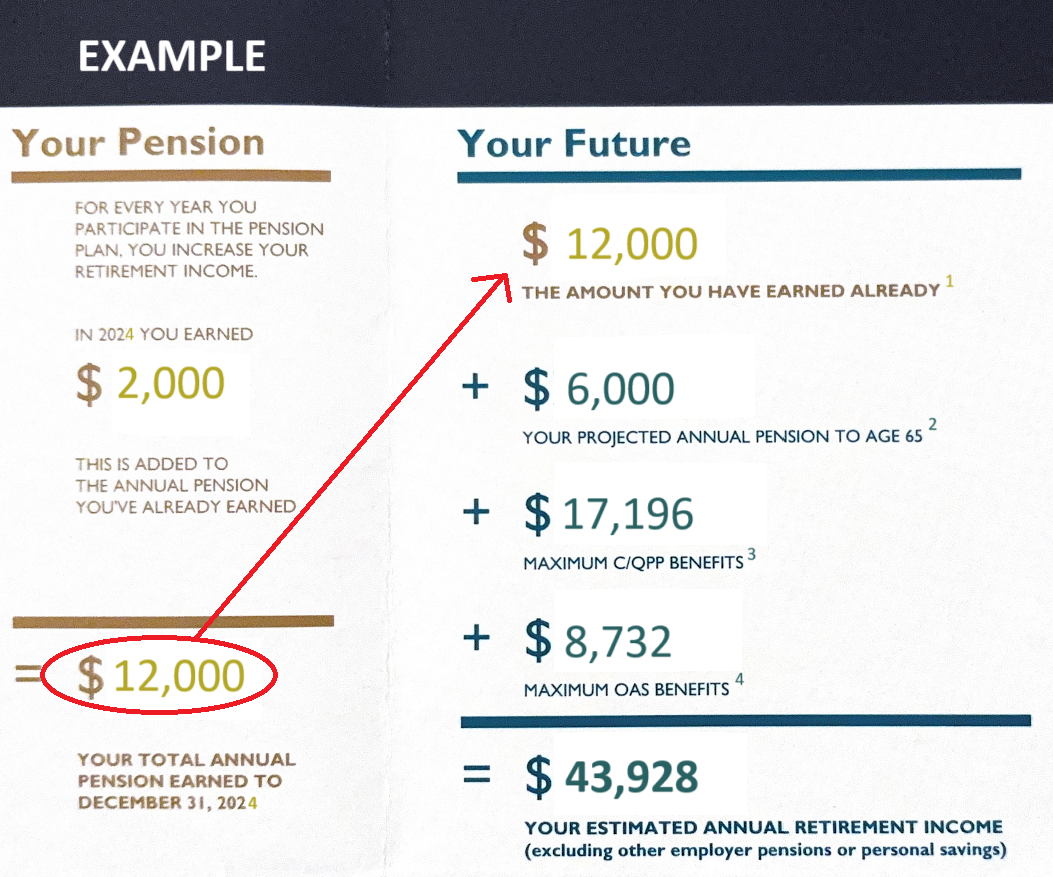

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

1THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

2YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue working in the same job category until you reach age 65. If you stop working before then, or if your pensionable earnings change, this amount will also change.

3MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2025 is $10,796.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

4MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($93,454, for 2025) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

Feeling stressed about finances? You're not alone. Economic hardships can make managing money feel overwhelming. But there's good news! By assessing your finances and creating a plan to achieve your goals, you can reduce stress and boost your financial wellbeing.

Our Employee and Family Assistance Program (EFAP) provides numerous resources on the WorkHealthLife website. Search "The United Church of Canada" to gain access to articles and resources, such as:

Money and your mind: taking care of your finances and mental health

Financial health: how your finances affect your mind

Millennials: Your financial future is now

Mental Health Awareness Month

May is also Mental Health Awareness Month, a perfect time to focus on your overall wellbeing. Here are some important dates to keep in mind:

Let's make May a month of empowerment and positive change!

Pension Awareness Day 2025 is on Thursday, February 20, and we are encouraging you to discover the value of a pension. This day is the perfect opportunity to reflect on your retirement planning, stay informed, and take the necessary steps to achieve a more secure financial future for you and your family.

What is Pension Awareness Day?

Pension Awareness Day is a time to raise awareness about the value of pension savings, the many benefits your pension plan offers, and the need to develop a retirement plan as early as possible.

The value of a pension

A pension plan is designed to provide income after retirement, so you won’t have to rely solely on government benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS), which may not be enough to cover all your expenses.

Employees of The United Church of Canada (UCC) who work an average of 14 or more hours per week, contribute to a Defined Benefit plan.

With the rising cost of living and longer life expectancies, government pensions may not be enough to cover all your retirement expenses. In 2024, the average Canada Pension Plan (CPP) benefit at 65 was $805 per month (with a maximum of $1,364.60), and the maximum Old Age Security (OAS) benefit was $725 per month, rising at age 75 to $800 per month.

Tools and Resources

Check out our pension tools and resources to learn more about:

From the Government of Canada:

Join our webinars on ChurchX to delve deep into retirement planning and your pension plan benefits:

Boundaries Refresher: Retiring with Grace (for ministry personnel only)

As we approach the end of the year, it's the perfect time to reflect on our health and well-being. Teladoc Medical Experts is here to support you with a range of unique medical services designed to provide peace of mind and expert guidance. Stay healthy and informed this December with Teladoc's newsletter.

Expert Medical Opinion

Have you ever felt uncertain about a diagnosis or treatment plan? With Teladoc's Expert Medical Opinion service, you can receive an evaluation of your diagnosis and treatment plan from a carefully selected expert. This ensures you have the confidence and clarity needed to make informed decisions about your health.

Personal Health Navigator

Navigating the healthcare system can be overwhelming. The Personal Health Navigator service empowers you to make informed decisions about your care. Whether you need help understanding your options or connecting to valuable resources, their navigators are there to guide you every step of the way.

Finding a Doctor

Finding the right specialist can be challenging. Teladoc offers access to an extensive network of experts, ensuring you can find the specialist you need in your local area. Their network is designed to connect you with top-tier medical professionals who can address your specific health concerns.

Care Finder

For those seeking specialized care outside of Canada, the Care Finder service is invaluable. With a global database of over 50,000 expert physicians across more than 450 specialties and subspecialties, Teladoc can help you locate the right specialist no matter where you are.

You can access Teladoc Medical Experts by calling 1-877-419-2378 or visiting their website. You'll be connected to a Member Advocate, a Registered Nurse, who will assess your needs and provide the services designed to help you confidently move forward with your care.

As part of GreenShield’s commitment to delivering an exceptional member experience, they will be modernizing their compound policy. This will be implemented in several phases, focusing on specific reimbursement conditions and compound categories. Phase 1 is projected to be implemented on September 3, 2024.

Biosimilar transitioning British Columbia

In May 2019, the British Columbia (B.C.) government implemented a biosimilar switching policy under its public prescription drug insurance plan. In December 2023, BC PharmaCare announced it would provide a six-month transitional period to allow those using Humalog (insulin lispro), used to treat diabetes, with an Omnipod, Ypsomed, Tandem, or Medtronic pump to transition to the biosimilar, Admelog by May 30, 2024. Health Canada has approved Admelog for use with these pumps, and it is a regular PharmaCare benefit. Patients with new approvals for insulin pumps are expected to use Admelog. Details can be found on the BC PharmaCare website.

In accordance with provincial coordination policies, GreenShield will expand their standard Biosimilar Transition Program in British Columbia to include Humalog for those using an Omnipod, Ypsomed, Tandem, or Medtronic pump. Unless an exception applies, the program will transition on July 22, 2024.

GSC have notified plan members that they must transition to Admelog by July 22, 2024. Plan members claiming Humalog and coordinating benefits with the BC PharmaCare Drug Plan will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber for transitioning support, including obtaining a new prescription for Admelog, if necessary. However, if BC PharmaCare grants an exception to allow a plan member to remain on Humalog, GreenShield will follow suit and pay for Humalog to enable continued coordination of claims.

Biosimilar transitioning Quebec

In April 2022, the Government of Quebec implemented a biosimilar switching policy under its public prescription drug insurance plan. On December 12, 2023, Régie de l'assurance maladie du Québec (RAMQ) announced as of December 13, 2023, the biologic Lucentis (ranibizumab), used to treat various eye conditions, will no longer be listed on the List of Medications and RAMQ patients being treated with Lucentis were required to transition to the biosimilar, Byooviz by May 22, 2024. Details can be found on the Infolettre RAMQ (available only in French).

GreenShield will also expand their standard Biosimilar Transition Program in Quebec to include Lucentis. Unless an exception applies, the transition date will be August 22, 2024.

GSC have notified plan members that they must transition to Byooviz by August 22, 2024. Plan members claiming Lucentis (including those coordinating with another drug plan) will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber or pharmacist for transitioning support, including obtaining a new prescription for Byooviz, if necessary.

Per RAMQ criteria, exemptions will apply to:

If you have any questions, please contact Benefits@united-church.ca

You should have received your 2023 Pension Statement in the mail these last few weeks. If you have not received your statement and are paid through ADP, please contact them directly to ensure the address on file is correct, then contact pension@united-church.ca to request a duplicate statement.

You will notice that your beneficiaries are not shown on your Annual Pension Statement. Please read the insert provided with your statement that explains why your beneficiaries are not listed. You can also read it here.

This is a standard practice in a transition to a new system. As part of the portal launch process, we will require all members to update their beneficiary information for both the pension and benefit plans (as applicable). Rest assured, the beneficiary information that you have previously provided is in place until such time as the new tool is live and you have confirmed your existing designation(s) or have designated new beneficiaries.

If you have any further questions, please email pension@united-church.ca.

Annual member statements for the 2023 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2024. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

| Your Pension | Your Future |

| FOR EVERY YEAR YOU PARTICIPATE IN THE PENSION PLAN YOU INCREASE YOUR RETIREMENT INCOME | $XX,XXX

THE AMOUNT YOU HAVE EARNED ALREADY |

| IN 2023, YOU EARNED

$X,XXX THIS IS ADDED TO THE ANNUAL PENSION YOU’VE ALREADY EARNED |

+ XX,XXX

YOUR PROJECTED ANNUAL PENSION TO AGE 65 |

| + 16,375

MAXIMUM C/QPP BENEFITS (in January 2024) |

|

| + 8,560

MAXIMUM OAS BENEFITS (April to June 2024) |

|

| = $XX,XXX

YOUR TOTAL ANNUAL PENSION EARNED TO DECEMBER 31, 2023 |

= $XX,XXX

YOUR ESTIMATED ANNUAL RETIREMENT INCOME (excluding other employer pensions or personal savings) |

THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue to work in the same job category until you reach age 65. If you stop working before that, or if your pensionable earnings change, this amount will also change.

MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2024 is $9,983.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($90,997, for 2024) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

GreenShield has advised that their union represented employees have voted in favour of a new, 3-year collective agreement with Green Shield Canada.

The GreenShield contact centre will reopen on Monday, April 22, however, it is anticipated that call volumes may be higher than usual at this time.

GreenShield continues to encourage members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices. For support checking your coverage online, please visit their self-service page.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca

GreenShield's collective agreement with Unifor expired on Friday, March 1, leading to a strike. GreenShield has activated its contingency plan to ensure essential services continue during the strike.

GreenShield remains optimistic that a settlement can be reached through constructive and focused discussions.

Online services, including claim submissions, continue to be available and are not impacted by the Unifor strike, and there will be no interruption to the health and administrative services that GreenShield provides.

The GreenShield contact centre is closed during the strike, but you will still be able to use GreenShield’s online services or their self-serve phone system depending on your needs. Since 94% of claims are submitted online, online service claims continue to be processed; other online services that most members rely on also remain available with minimal disruption.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

GreenShield encourages members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices.

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca