Good news! Pension plan members will receive a pension increase effective January 1, 2026.

Pensioners and Deferred Members

Current pensioners and deferred members will receive a 2 percent* increase to their pension amount effective January 1, 2026.

* The Income Tax Act and regulations and the Plan, limit pension increases to the cumulative growth in Consumer Price Index since the pension commenced. For this reason, recently retired pensioners and deferred members who terminated active membership recently may see a lesser increase.

Active Members

For active members, the accrual rate will stay at 1.85 percent in 2026 from the base rate of 1.4 percent. In 2027 the accrual rate is scheduled to return to 1.4 percent.

What Does “Accrual Rate” Mean?

The accrual rate is the rate at which you earn your pension. In 2026, you earn your pension at the rate of x percent of your pensionable earnings.

How Does This Work?

You earn a piece of pension every year that you work and contribute to the plan—like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year, (for easy figuring). From 2019, that member would earn

|

Year |

Accrual Rate | Formula |

Pension Credit Earned |

|

2019 |

1.4% | 1.4% of $60,000 | $ 840 |

|

2020 |

1.85% | 1.85% of $60,000 | $ 1,110 |

|

2021 |

1.625% | 1.625% of $60,000 |

$ 975 |

| 2022 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2024 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2025 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2026 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2027 | 1.4% | 1.4% of $60,000 |

$ 840 |

At the end of your career, the annual pension amounts earned each year will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2026 will continue to benefit you for the rest of your retired life.

What about Future Increases?

There is no automatic indexing in our plan. The Pension Board and Pension Plan Advisory Committee annually assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

The holiday season is a time of celebration, but it can also bring added stress and pressure. Between year-end deadlines, family commitments, and financial strain, it’s easy to feel overwhelmed. In December, we’re focusing on two powerful tools to help you navigate the season: gratitude and stress management.

Why Gratitude Matters

Practicing gratitude isn’t just about saying “thank you”—it’s about shifting your perspective. Research shows that gratitude can:

Quick Tip: Start a gratitude list. Each day, write down three things you’re thankful for—big or small. It’s a simple habit that can make a big difference!

Managing Holiday Stress

The holidays can be joyful, but they can also be hectic. Here are a few strategies to keep your stress from sleigh-ing you this season!

The season is about connection and kindness, toward others and yourself, so let’s make space for gratitude and well-being as we close out the year.

Employee and Family Assistance Program (EFAP)

Just a reminder, if you want to access services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

Website: one.telushealth.com

Username: unitedchurch

Password: eap

November is a time to reflect on the importance of your mental and physical health. Prioritizing regular screenings, staying active, and taking time to check in with yourself can make a significant difference in your overall wellbeing and vitality. On November 16, it is the International Day for Tolerance. Tolerance begins with listening and creating safe spaces for honest conversations, so let’s embrace empathy, understanding, and support for one another.

Mental health is just as important as physical health, yet many men face unique challenges when it comes to seeking support. Societal expectations and stigma can make it harder to talk about emotional struggles, stress, or anxiety. Mental health affects everything—from your relationships and work performance to your physical health and quality of life.

Ignoring mental health concerns can lead to serious consequences, including increased risk of chronic illness, substance use, and eating disorders. Taking care of your mental wellbeing is a sign of strength, not weakness.

Movember

Movember is dedicated to raising awareness about men’s health issues, including prostate cancer, testicular cancer, and mental health. It’s a reminder to take action, support one another, and speak openly about health concerns.

Take the First Step

Our Employee and Family Assistance Program (EFAP)

We’re excited to share updated access details for our EFAP—a confidential, 24/7 support resource for you and your family. Whether you're navigating personal challenges, seeking financial guidance, or looking for wellness tools, the EFAP is here to support you.

New Access Link: one.telushealth.com

Username: unitedchurch

Password: eap

To access services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account. Visit the EFAP portal anytime to explore services, book appointments, or access helpful articles and tools.

Your health matters. Let’s make November a month of action, awareness, and support.

As autumn settles in, many of us notice subtle shifts — in the weather, in our routines, and sometimes, in our mood. October is a powerful time to reflect on mental health, especially with World Mental Health Day observed globally on October 10th. This year’s theme reminds us that mental health is a universal human right, and that includes every one of us.

World Mental Health Day is more than a date on the calendar. It’s a global movement to raise awareness, reduce stigma, and promote access to mental health support. Whether you're thriving, struggling, or somewhere in between, this day is a reminder: your mental health matters.

What’s the Difference?

Signs to Look Out For

If these symptoms resonate with you or someone you know, know that you're not alone. Support is available through our Employee and Family Assistance Program (EFAP), which offers confidential support, counseling, and referrals.

Let’s Normalize the Conversation

Discover how to harness your strengths, express your needs, and build pathways to success by joining Canada Life’s upcoming webinar: Neurodiversity Works – Unlocking the Power of Different Minds in the Workplace. You’ll gain practical tips and strategies to help create inclusive workplaces that support neurodivergent colleagues—either for yourself or your team. The event will be recorded so it can be accessed after the live event on the Workplace Strategies for Mental Health YouTube channel.

Date: October 9, 2025

Time: 1:00 – 2:00 p.m. EDT

Mental health conversations belong in every workplace. By speaking openly, we help create a culture where vulnerability is met with empathy, and seeking help is seen as a strength. Let’s honor World Mental Health Day by continuing to build a workplace where mental health is prioritized, and kindness is part of our culture.

September is here and the back-to-school season begins. Some of us are adjusting to new routines, shifting schedules, and the changing pace of fall–post General Council! If you're a parent managing school drop-offs or simply feeling the seasonal shift, September is a great time to refocus.

Reboot Your Routine

The structure of the school year can help you build healthy habits that support your work-life balance:

Working Parents

Balancing work and family during back-to-school season can be challenging. Here are a few tips to support your well-being:

Just like learning, wellness is a journey, not a destination, so let’s remember to treat ourselves with the same care and encouragement we give to students starting a new year.

As summer winds down, August offers a natural moment to pause, reflect, and reset. Whether you're working toward professional development, project goals, or personal growth, setting intentional goals can help you stay focused and energized.

But goal setting doesn’t have to live in separate silos. In fact, aligning your work goals with your personal wellness goals can lead to greater balance, resilience, and satisfaction, both on and off the job.

Here are a few ways to approach goal setting with wellness in mind:

Reconnect with Your Purpose

What motivates you in your role, and in your life? Aligning your goals with your values and strengths can make your work more meaningful and your personal growth more fulfilling.

Set Clear, Achievable Targets

Break larger objectives into smaller, manageable steps. Whether it’s completing a project or committing to a daily walk, small wins build momentum.

Prioritize Well-Being

Consider how your goals support your mental health, energy levels, and work-life balance. A healthier you is a more focused and productive you.

Stay Flexible

Life and work are dynamic. Give yourself permission to adapt your goals as needed. Progress isn’t always linear.

Celebrate Wins—Big and Small

Recognizing your efforts boosts morale and reinforces positive habits. Take time to acknowledge what you’ve accomplished—professionally and personally.

When you log into your GreenShield+ account, you’ll find a variety of tools and resources on the Well-Being page designed to support your health goals. From interactive activities and mini courses (like improving posture—perfect for those of us at a desk all day!) to a personalized health score that helps you track your progress, it’s all there to help you take small, meaningful steps toward better well-being.

The Benefits Centre is pleased to share information about new services available to Indigenous staff and ministry personnel. These services will provide culturally appropriate support and guidance, ensuring that Indigenous members of the church have access to resources that reflect their own needs and experiences.

Green Shield Canada is partnering with Noojimo Health, an Indigenous-owned organization, to offer culturally safe and timely virtual mental health services. Noojimo Health is the first all-Indigenous virtual mental wellness clinic for Indigenous people. The following services are delivered by Indigenous registered social workers through virtual sessions and phone calls:

The program can be accessed via GreenShield+, under Care Services > Mental Health > Indigenous Mental Health:

These services are available at no cost to members. Some individuals may be eligible to receive up to 22 hours of counselling each year through the Non-Insured Health Benefits (NIHB) program.

You should have received your 2024 Pension Statement in the mail these last few weeks. If you have not received your statement and are paid through ADP, please contact them directly to ensure the address on file is correct, then contact pension@united-church.ca to request a duplicate statement.

You will notice that your beneficiaries are not shown on your Annual Pension Statement. Please read the insert provided with your statement that explains why your beneficiaries are not listed. You can also read it here.

This is a standard practice in a transition to a new system. As part of the portal launch process, we will require all members to update their beneficiary information for both the pension and benefit plans (as applicable). Rest assured, the beneficiary information that you have previously provided is in place until such time as the new tool is live and you have confirmed your existing designation(s) or have designated new beneficiaries.

If you have any further questions, please email pension@united-church.ca.

Whether it’s stepping away from your desk, reading a book, or setting healthy boundaries in your personal life, self-care is about showing up for yourself in meaningful ways—big and small. This July, we’re celebrating the importance of self-care and friendship, with two key dates to mark on your calendar:

Caring for your whole self is essential to living your healthiest life. This includes your mental, physical, emotional, spiritual, and practical self-care. Here are some examples – with resources from the GreenShield+ Wellness Hub and WorkHealthLife* – on how you can prioritize you.

*Enter The United Church of Canada to gain access to the site.

Mental Self-Care

Physical Self-Care

Emotional Self-Care

Spiritual Self-Care

Practical Self-Care

This month, let’s commit to nurturing ourselves and those around us, because when we care for ourselves, we’re better equipped to care for others.

Annual member statements for the 2024 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2025. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

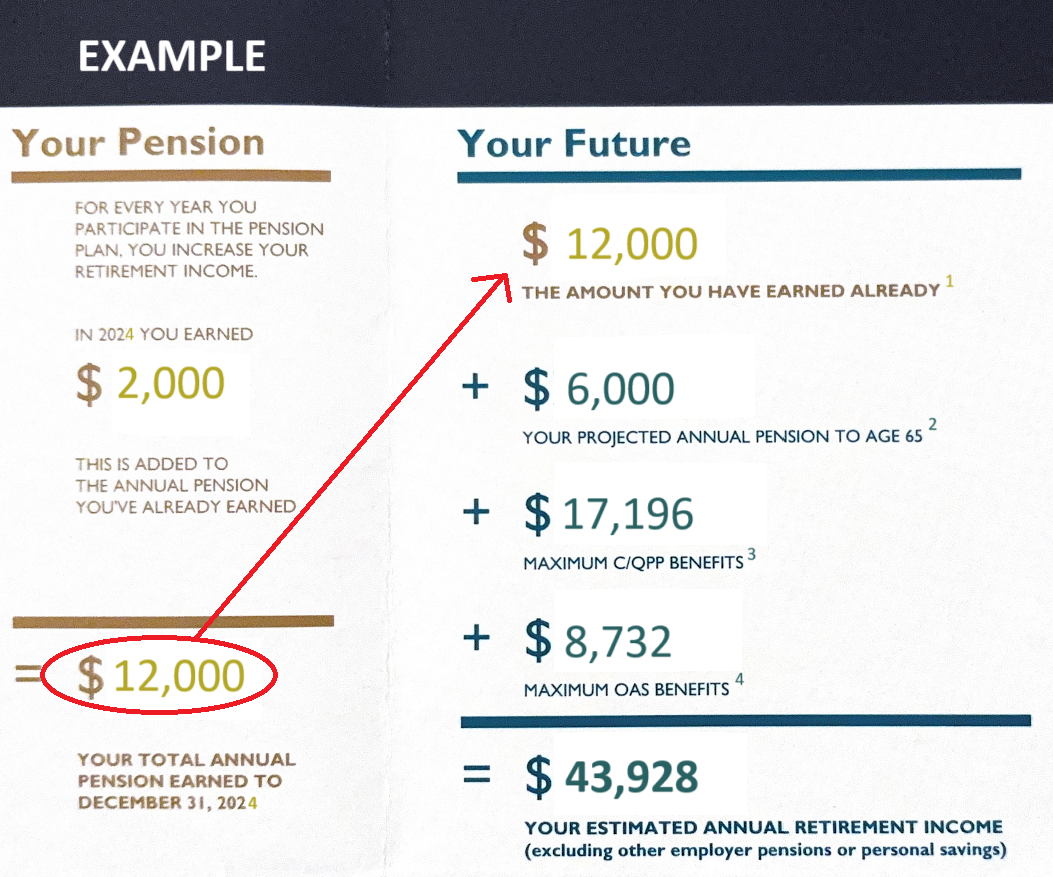

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

1THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

2YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue working in the same job category until you reach age 65. If you stop working before then, or if your pensionable earnings change, this amount will also change.

3MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2025 is $10,796.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

4MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($93,454, for 2025) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.