Amid widespread reporting about the risks of artificial general intelligence, Alphabet (formerly Google) shareholders voted on June 2 on a proposal, filed by SHARE on behalf of the Pension Plan of The United Church of Canada, requesting third-party scrutiny of the company’s targeted advertising system.

The proposal calls for the company to undertake a human rights impact assessment and states the growing concerns surrounding Alphabet’s advertising infrastructure’s heavy reliance on technology, including artificial intelligence, which has not been subject to a robust human rights due diligence process. This kind of assessment would identify, address, and prevent the potential adverse human rights impact of targeted advertising technologies.

“Alphabet’s targeted advertising business represents about 80% of the company’s revenue, which means that until a rigorous assessment is done, its shareholders are exposed to a litany of regulatory, legal and reputational risks,” said Sarah Couturier-Tanoh, Associate Director Corporate Engagement and Advocacy at SHARE. “Ultimately, the lack of clear oversight puts investors’ long-term value at risk.”

Proxy advisory firms Glass Lewis and Institutional Shareholder Services, and large U.S.-based pension funds CalPERS, CalSTRS, New York City pension funds, and Norges Bank all agreed with SHARE’s perspective on the matter.

The proposal received 47% support from independent shareholders and 18% overall. The sharp difference between these two figures is explained by the multi-class stock structure conferring 10 votes for 1 share held by Alphabet’s management. SHARE opposes multi-class stock structures as a general principle of good corporate governance.

While our shareholder proposal ultimately did not pass, the nearly 50% support of independent shareholders is a strong signal to Alphabet management that there is great concern about, and now scrutiny of, their targeted advertising system. Often corporate engagement is a process of incremental gains requiring persistence. Persistence is something that the Pension Fund of The United Church of Canada has in abundance when it comes to investing responsibly!

This reminder is a follow-up to notices shared late last year and earlier this year with community of faith treasurers and administrators, as well as ministry personnel, about changes to the regional cost of living group assignments. A copy of the letter shared with treasurers and administrators is in the Downloads section at the bottom of the Ministers’ Salary Schedule and Cost of Living Groups webpage.

These changes will be effective for the pay period beginning July 1, 2023, and apply to the balance of the year. You can find the revised cost of living group assignment data in the Downloads section as well.

If your regional COL group assignment has moved up, your ADP administrator will need to update the minister’s salary in TeamPay or inform ADP of the new salary amount for the pay period beginning July 1.

Salaries for ministry personnel serving in locations where the regional COL group assignment has been adjusted down will be maintained as per the terms of the appointment or call. This includes those whose appointments renew. This means that if the pastoral charge is in a lower cost of living group, the current minister’s salary may not be reduced. It will remain subject to the annual economic adjustment to minimum salaries or as defined in the terms of appointment or call.

There is no change to the COL group for 45 percent of communities of faith. Thirty-nine percent of communities of faith have stepped up one group. Sixteen percent have stepped down one group. These changes reflect regional differences in the costs of housing, property and provincial income taxes, utilities, and goods and services.

The accrual rate is the rate at which you earn your pension. In 2023, you will earn your pension at the rate of 1.85% of your pensionable earnings.

You earn a piece of pension every year that you work and contribute to the plan―like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year (for easy figuring). From 2019 to 2024, that member would earn:

| Year | Accrual Rate | Formula | Pension Credit Earned |

| 2019 | 1.4% | 1.4% of $60,000 | $ 840 |

| 2020 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2021 | 1.625% | 1.625% of $60,000 | $ 975 |

| 2022 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2024 | 1.4% | 1.4% of $60,000 | $ 840 |

At the end of your career, the annual pension amounts earned each year (pension credits) will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2023 will continue to benefit you for the rest of your retired life.

There is no automatic indexing or increases in our pension plan. Each year, the Pension Board and Pension Plan Advisory Committee assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

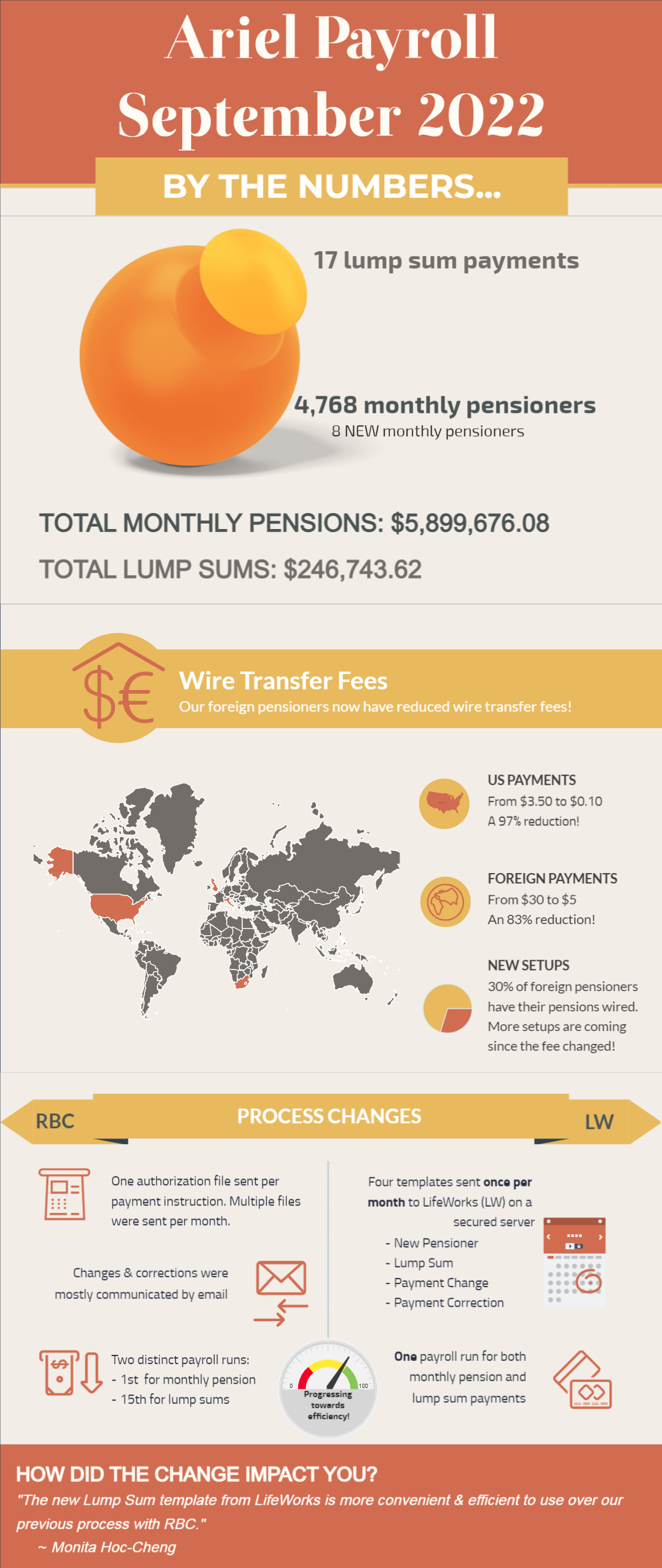

The Benefits Centre team is pleased to announce that we have made 17 lump sum payments and 4,768 regular pension payments following the transition from RBC Investor and Treasury Services to LifeWorks in May. All thanks to LifeWorks' Ariel payroll system that streamlined the payroll run and generated one payroll run instead of two for monthly pensions and lump sums. Check out more details below!

The first letter from the Benefits Centre informing pensioners about the change to the processing of pension payments - from RBC Investor and Treasury Services to LifeWorks.

The second mailing in June was divided into three letters depending on where you are currently residing:

The second communication from the Benefits Centre was mailed the week of June 15, with more information on T4As for the 2022 year, and about the Web portal - which will be available to all in October 2023 but will be optional. Just a reminder, there is nothing for you, as a pensioner, to do on your end.

Three versions of the letter were mailed - depending on your current location - and they are all posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.

First Mailing - First Letter

Second Mailing -

An initial communication from the Benefits Centre was mailed the week of May 23, informing pensioners of the upcoming change to how pension payments are processed. One important thing to note is that there is nothing for you, as a pensioner, to do on your end. More information about the change will be mailed in June providing contact details.

A copy of the letter is posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.

After a year-long hiatus, Connex is back! This version will pick up where the print version left off and will only be available online. Going forward, Connex will focus mainly on pension, benefits, and payroll news.

If you were previously receiving an email about Connex and didn’t see it in your inbox, check your spam folder! If it’s still not there and you would like to receive Connex, please sign up for the latest news and updates on the Newsroom page by filling out the form below.

Previous issues of Connex can be found on the United Church Commons, under Communications, Publications and Media.

Are you looking to augment the Active member health and dental plan? Here are a few things to consider:

The United Church plan, the United Church rates

Other plans

Can I opt-out of the United Church Health & Dental Plan?

A letter from the General Secretary, Michael Blair, was sent to all retirees on November 22, 2021 that outlined recent discussions and decisions about benefits for retirees of the United Church. You can review the General Secretary's letter here.

If you are a retired member of the United Church and did not receive this communication by email or Canada Post, please contact UCCBenefitsNews@united-church.ca to provide your current information so we can update our records.

The plan summary for the Health and Dental Benefits for Active Members, effective January 1, 2022, is now posted on the Group Benefits page, under Life, Health and Dental, Disability Benefits. Please note, this plan summary is subject to a final review by external consultants. If you have any questions, please email benefits@united-church.ca. The General Council Office will reopen on January 4, 2022.