Whether it’s stepping away from your desk, reading a book, or setting healthy boundaries in your personal life, self-care is about showing up for yourself in meaningful ways—big and small. This July, we’re celebrating the importance of self-care and friendship, with two key dates to mark on your calendar:

Caring for your whole self is essential to living your healthiest life. This includes your mental, physical, emotional, spiritual, and practical self-care. Here are some examples – with resources from the GreenShield+ Wellness Hub and WorkHealthLife* – on how you can prioritize you.

*Enter The United Church of Canada to gain access to the site.

Mental Self-Care

Physical Self-Care

Emotional Self-Care

Spiritual Self-Care

Practical Self-Care

This month, let’s commit to nurturing ourselves and those around us, because when we care for ourselves, we’re better equipped to care for others.

As we step into June, we embrace a month rich with meaning, reflection, and celebration. It’s a time to honor our differences, uplift voices that have been marginalized, and recommit to building a more equitable, and sustainable world.

This month is a reminder of the importance of diversity in all its forms. It’s a time to reflect on how we can create spaces where everyone feels seen, heard, and valued. Equity is not just a goal—it’s a practice we must embed in our everyday actions and decisions.

Pride 2025

June is also a celebration of the 2S and LGBTQIA+ community’s resilience, creativity, and contributions to society. It’s a time to honor the history of the Pride movement, recognize the ongoing struggles for equality, and stand in solidarity with those advocating for love, dignity, and justice.

World Environment Day

Don’t forget to mark your calendars on June 5 for World Environment Day – a global call to action to protect our planet. This year’s theme emphasizes the urgent need to restore ecosystems and combat climate change. As we celebrate our human diversity, let’s also remember our shared responsibility to care for the Earth, our common home.

Whether it’s attending a Pride event, participating in a sustainability initiative, or learning more about the United Church’s practices (Disability, Accessibility and Inclusion, Gender, Sexuality, and Orientation, and Equity, Accessibility and Privacy) there’s a place for everyone in this journey. Let’s celebrate love in all its forms and continue to push for a world where everyone can live authentically and safely.

Here are a few articles you can check out on GreenShield+:

Good news! Pension plan members will receive a pension increase effective January 1, 2025. Due to the Canada Post strike, you will receive the letter from Pension Board Chair, Anne Soh, once the strike has been resolved. You can access the letter electronically here:

Pensioners and Deferred Members

Current pensioners and deferred members will receive a 2.7 percent* increase to their pension amount effective January 1, 2025.

* The Income Tax Act and regulations and the Plan, limit pension increases to the cumulative growth in Consumer Price Index since the pension commenced. For this reason, recently retired pensioners and deferred members who terminated active membership recently may see a lesser increase.

Active Members

For active members, the accrual rate will stay at 1.85 percent in 2025, up from the base rate of 1.4 percent. In 2026 the accrual rate is scheduled to return to 1.4 percent.

What Does “Accrual Rate” Mean?

The accrual rate is the rate at which you earn your pension. In 2025, you earn your pension at the rate of 1.85 percent of your pensionable earnings.

How Does This Work?

You earn a piece of pension every year that you work and contribute to the plan—like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year, (for easy figuring). From 2019, that member would earn

|

Year |

Accrual Rate | Formula |

Pension Credit Earned |

|

2019 |

1.4% | 1.4% of $60,000 | $ 840 |

|

2020 |

1.85% | 1.85% of $60,000 | $ 1,110 |

|

2021 |

1.625% | 1.625% of $60,000 |

$ 975 |

| 2022 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2024 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2025 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2026 | 1.4% | 1.4% of $60,000 |

$ 840 |

At the end of your career, the annual pension amounts earned each year will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2025 will continue to benefit you for the rest of your retired life.

What about Future Increases?

There is no automatic indexing in our plan. The Pension Board and Pension Plan Advisory Committee annually assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

As part of GreenShield’s commitment to delivering an exceptional member experience, they will be modernizing their compound policy. This will be implemented in several phases, focusing on specific reimbursement conditions and compound categories. Phase 1 is projected to be implemented on September 3, 2024.

Biosimilar transitioning British Columbia

In May 2019, the British Columbia (B.C.) government implemented a biosimilar switching policy under its public prescription drug insurance plan. In December 2023, BC PharmaCare announced it would provide a six-month transitional period to allow those using Humalog (insulin lispro), used to treat diabetes, with an Omnipod, Ypsomed, Tandem, or Medtronic pump to transition to the biosimilar, Admelog by May 30, 2024. Health Canada has approved Admelog for use with these pumps, and it is a regular PharmaCare benefit. Patients with new approvals for insulin pumps are expected to use Admelog. Details can be found on the BC PharmaCare website.

In accordance with provincial coordination policies, GreenShield will expand their standard Biosimilar Transition Program in British Columbia to include Humalog for those using an Omnipod, Ypsomed, Tandem, or Medtronic pump. Unless an exception applies, the program will transition on July 22, 2024.

GSC have notified plan members that they must transition to Admelog by July 22, 2024. Plan members claiming Humalog and coordinating benefits with the BC PharmaCare Drug Plan will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber for transitioning support, including obtaining a new prescription for Admelog, if necessary. However, if BC PharmaCare grants an exception to allow a plan member to remain on Humalog, GreenShield will follow suit and pay for Humalog to enable continued coordination of claims.

Biosimilar transitioning Quebec

In April 2022, the Government of Quebec implemented a biosimilar switching policy under its public prescription drug insurance plan. On December 12, 2023, Régie de l'assurance maladie du Québec (RAMQ) announced as of December 13, 2023, the biologic Lucentis (ranibizumab), used to treat various eye conditions, will no longer be listed on the List of Medications and RAMQ patients being treated with Lucentis were required to transition to the biosimilar, Byooviz by May 22, 2024. Details can be found on the Infolettre RAMQ (available only in French).

GreenShield will also expand their standard Biosimilar Transition Program in Quebec to include Lucentis. Unless an exception applies, the transition date will be August 22, 2024.

GSC have notified plan members that they must transition to Byooviz by August 22, 2024. Plan members claiming Lucentis (including those coordinating with another drug plan) will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber or pharmacist for transitioning support, including obtaining a new prescription for Byooviz, if necessary.

Per RAMQ criteria, exemptions will apply to:

If you have any questions, please contact Benefits@united-church.ca

GreenShield has advised that their union represented employees have voted in favour of a new, 3-year collective agreement with Green Shield Canada.

The GreenShield contact centre will reopen on Monday, April 22, however, it is anticipated that call volumes may be higher than usual at this time.

GreenShield continues to encourage members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices. For support checking your coverage online, please visit their self-service page.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca

GreenShield's collective agreement with Unifor expired on Friday, March 1, leading to a strike. GreenShield has activated its contingency plan to ensure essential services continue during the strike.

GreenShield remains optimistic that a settlement can be reached through constructive and focused discussions.

Online services, including claim submissions, continue to be available and are not impacted by the Unifor strike, and there will be no interruption to the health and administrative services that GreenShield provides.

The GreenShield contact centre is closed during the strike, but you will still be able to use GreenShield’s online services or their self-serve phone system depending on your needs. Since 94% of claims are submitted online, online service claims continue to be processed; other online services that most members rely on also remain available with minimal disruption.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

GreenShield encourages members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices.

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca

These are early days for the federal plan, so stay tuned for any changes. We’ve just recently been advised that people who opted out of an employer’s retiree health and dental benefit plan before December 11, 2023, and cannot opt back in under the plan rules, are eligible for the Canadian Dental Care Plan (CDCP). Anyone who chooses to opt out after this date will not be eligible.

The following is the eligibility criteria of the Canadian Dental Care Plan that was updated on March 4, 2024 on the Government of Canada website.

Eligibility criteria

To qualify for the CDCP, you must:

You need to meet all the eligibility criteria to qualify for the CDCP.

If you have any questions about eligibility for the Canadian Dental Care Plan, please email benefits@united-church.ca or call the Benefits Centre at 1-855-647-8222.

Good news! As announced in a recent letter from Pension Board Chair, Anne Soh, pension plan members will receive a pension increase effective January 1, 2024.

Pensioners and Deferred Members

Current pensioners and deferred members will receive a 4 percent* increase to their pension amount effective January 1, 2024.

* The Income Tax Act and regulations limit pension increases to the cumulative growth in Consumer Price Index since the pension commenced. For this reason, recently retired pensioners and deferred members who terminated membership recently will see a lesser increase.

Active Members

For active members, the accrual rate will stay at 1.85 percent in 2024 from the base rate of 1.4 percent. In 2025 the accrual rate is scheduled to return to 1.4 percent.

What Does “Accrual Rate” Mean?

The accrual rate is the rate at which you earn your pension. In 2024, you earn your pension at the rate of 1.85 percent of your pensionable earnings.

How Does This Work?

You earn a piece of pension every year that you work and contribute to the plan—like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year, (for easy figuring). From 2019, that member would earn

|

Year |

Accrual Rate | Formula |

Pension Credit Earned |

|

2019 |

1.4% | 1.4% of $60,000 | $ 840 |

|

2020 |

1.85% | 1.85% of $60,000 | $ 1,110 |

|

2021 |

1.625% | 1.625% of $60,000 |

$ 975 |

| 2022 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2024 | 1.85% | 1.85% of $60,000 |

$ 1,110 |

| 2025 | 1.4% | 1.4% of $60,000 |

$ 840 |

At the end of your career, the annual pension amounts earned each year will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2024 will continue to benefit you for the rest of your retired life.

What about Future Increases?

There is no automatic indexing of our plan. The Pension Board and Pension Plan Advisory Committee annually assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

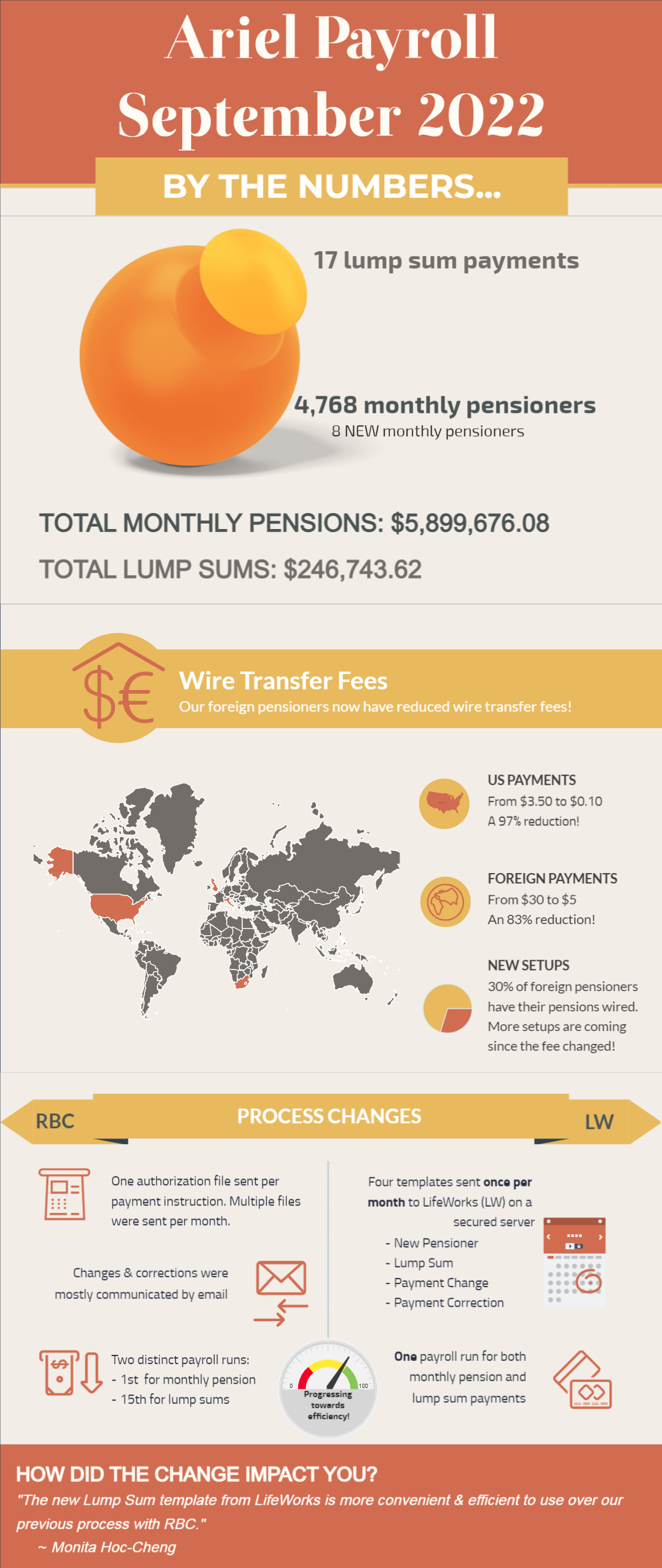

The Benefits Centre team is pleased to announce that we have made 17 lump sum payments and 4,768 regular pension payments following the transition from RBC Investor and Treasury Services to LifeWorks in May. All thanks to LifeWorks' Ariel payroll system that streamlined the payroll run and generated one payroll run instead of two for monthly pensions and lump sums. Check out more details below!

The first letter from the Benefits Centre informing pensioners about the change to the processing of pension payments - from RBC Investor and Treasury Services to LifeWorks.

The second mailing in June was divided into three letters depending on where you are currently residing:

The second communication from the Benefits Centre was mailed the week of June 15, with more information on T4As for the 2022 year, and about the Web portal - which will be available to all in October 2023 but will be optional. Just a reminder, there is nothing for you, as a pensioner, to do on your end.

Three versions of the letter were mailed - depending on your current location - and they are all posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.

First Mailing - First Letter

Second Mailing -