February often brings attention to heart health, but it’s also the perfect moment to reflect on the powerful connection between your emotional wellbeing and your physical health. These two parts of your life don’t operate in isolation; they influence each other every day.

When stress, worry, or emotional strain builds up, your body often feels it too. Fatigue, tension, changes in sleep, and shifts in energy can all be signs that your emotional wellbeing needs attention. And the reverse is just as true - when your body feels strong and supported, your mind is better equipped to stay balanced, focused, and resilient.

Healthy Heart & Mind Tips

Your emotional and physical wellbeing are deeply connected. February is a great time to reflect on that relationship and explore what helps you feel more grounded, energized, and well.

Just a reminder, if you want to access your EFAP services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

Website: one.telushealth.com

Username: unitedchurch

Password: eap

The Customer Contact Centre is currently experiencing elevated wait times due to a seasonal increase in call volume. To help reduce the impact of these high‑volume periods, several initiatives are underway:

Additional mitigation strategies—including overtime, cross‑functional support, and student staffing—continue to be used to help manage peak‑period demand. These combined efforts are intended to stabilize service levels as call volumes return to normal.

An apology is extended for any inconvenience these delays may cause for members.

Members are encouraged to use their GS+ accounts for self‑service options. You can also find answers to any FAQs through the GS+ Help Centre.

January is the perfect time to reflect on the past year and think about what you’d like to accomplish going forward. You can use this fresh start to evaluate your mental health and set emotional goals that truly works for you and your life.

Why it matters:

Your mental well-being influences every part of your life—from relationships and work to physical health. Setting intentional goals can help you feel more balanced and resilient throughout the year.

Ask yourself:

Even modest, consistent efforts can spark positive change!

Set Your Emotional Goal

Website: one.telushealth.com

Username: unitedchurch

Password: eap

Investing in your mental well-being is a gift that lasts all year. Let this be the season to pause, reflect, and grow with intention because new beginnings deserve renewed minds!

*Just a reminder, if you want to access services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

As summer winds down, August offers a natural moment to pause, reflect, and reset. Whether you're working toward professional development, project goals, or personal growth, setting intentional goals can help you stay focused and energized.

But goal setting doesn’t have to live in separate silos. In fact, aligning your work goals with your personal wellness goals can lead to greater balance, resilience, and satisfaction, both on and off the job.

Here are a few ways to approach goal setting with wellness in mind:

Reconnect with Your Purpose

What motivates you in your role, and in your life? Aligning your goals with your values and strengths can make your work more meaningful and your personal growth more fulfilling.

Set Clear, Achievable Targets

Break larger objectives into smaller, manageable steps. Whether it’s completing a project or committing to a daily walk, small wins build momentum.

Prioritize Well-Being

Consider how your goals support your mental health, energy levels, and work-life balance. A healthier you is a more focused and productive you.

Stay Flexible

Life and work are dynamic. Give yourself permission to adapt your goals as needed. Progress isn’t always linear.

Celebrate Wins—Big and Small

Recognizing your efforts boosts morale and reinforces positive habits. Take time to acknowledge what you’ve accomplished—professionally and personally.

When you log into your GreenShield+ account, you’ll find a variety of tools and resources on the Well-Being page designed to support your health goals. From interactive activities and mini courses (like improving posture—perfect for those of us at a desk all day!) to a personalized health score that helps you track your progress, it’s all there to help you take small, meaningful steps toward better well-being.

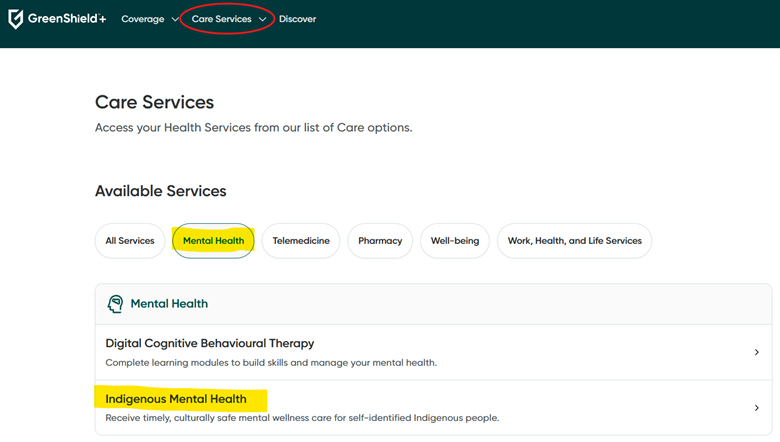

The Benefits Centre is pleased to share information about new services available to Indigenous staff and ministry personnel. These services will provide culturally appropriate support and guidance, ensuring that Indigenous members of the church have access to resources that reflect their own needs and experiences.

Green Shield Canada is partnering with Noojimo Health, an Indigenous-owned organization, to offer culturally safe and timely virtual mental health services. Noojimo Health is the first all-Indigenous virtual mental wellness clinic for Indigenous people. The following services are delivered by Indigenous registered social workers through virtual sessions and phone calls:

The program can be accessed via GreenShield+, under Care Services > Mental Health > Indigenous Mental Health:

These services are available at no cost to members. Some individuals may be eligible to receive up to 22 hours of counselling each year through the Non-Insured Health Benefits (NIHB) program.

Whether it’s stepping away from your desk, reading a book, or setting healthy boundaries in your personal life, self-care is about showing up for yourself in meaningful ways—big and small. This July, we’re celebrating the importance of self-care and friendship, with two key dates to mark on your calendar:

Caring for your whole self is essential to living your healthiest life. This includes your mental, physical, emotional, spiritual, and practical self-care. Here are some examples – with resources from the GreenShield+ Wellness Hub and WorkHealthLife* – on how you can prioritize you.

*Enter The United Church of Canada to gain access to the site.

Mental Self-Care

Physical Self-Care

Emotional Self-Care

Spiritual Self-Care

Practical Self-Care

This month, let’s commit to nurturing ourselves and those around us, because when we care for ourselves, we’re better equipped to care for others.

Annual member statements for the 2024 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2025. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

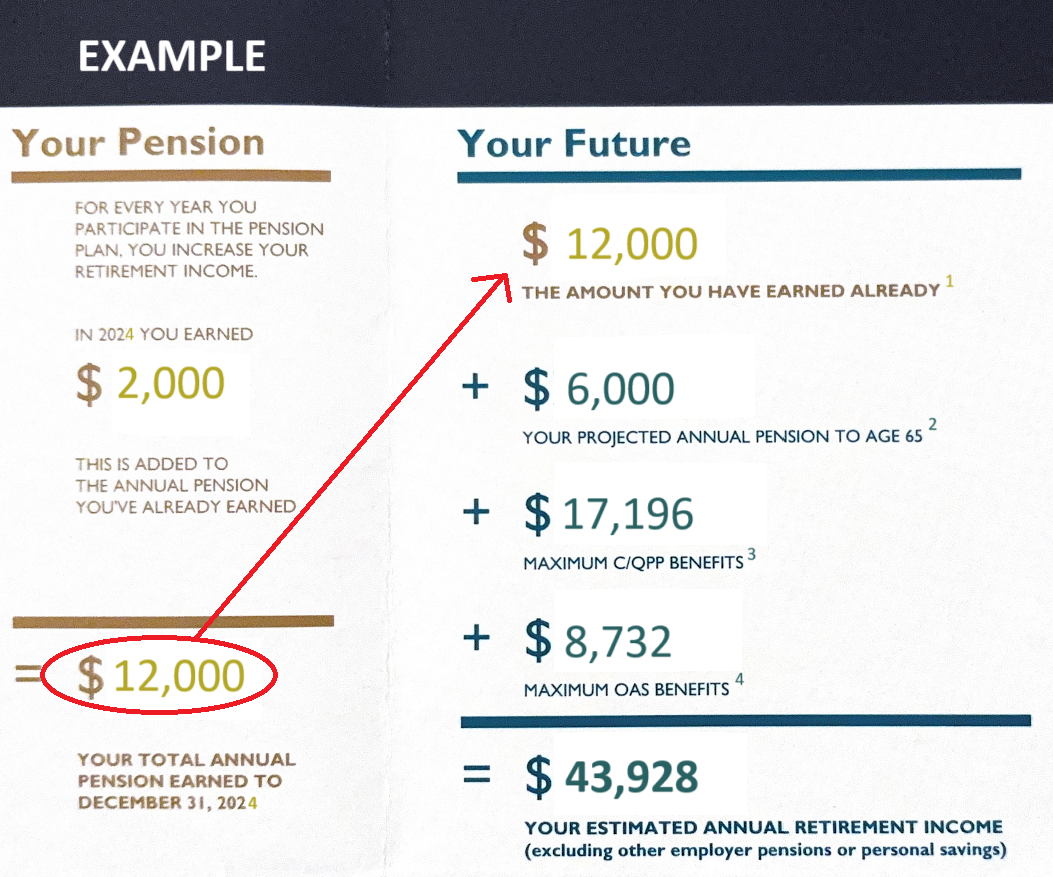

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

1THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

2YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue working in the same job category until you reach age 65. If you stop working before then, or if your pensionable earnings change, this amount will also change.

3MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2025 is $10,796.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

4MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($93,454, for 2025) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

Feeling stressed about finances? You're not alone. Economic hardships can make managing money feel overwhelming. But there's good news! By assessing your finances and creating a plan to achieve your goals, you can reduce stress and boost your financial wellbeing.

Our Employee and Family Assistance Program (EFAP) provides numerous resources on the WorkHealthLife website. Search "The United Church of Canada" to gain access to articles and resources, such as:

Money and your mind: taking care of your finances and mental health

Financial health: how your finances affect your mind

Millennials: Your financial future is now

Mental Health Awareness Month

May is also Mental Health Awareness Month, a perfect time to focus on your overall wellbeing. Here are some important dates to keep in mind:

Let's make May a month of empowerment and positive change!

Pension Awareness Day 2025 is on Thursday, February 20, and we are encouraging you to discover the value of a pension. This day is the perfect opportunity to reflect on your retirement planning, stay informed, and take the necessary steps to achieve a more secure financial future for you and your family.

What is Pension Awareness Day?

Pension Awareness Day is a time to raise awareness about the value of pension savings, the many benefits your pension plan offers, and the need to develop a retirement plan as early as possible.

The value of a pension

A pension plan is designed to provide income after retirement, so you won’t have to rely solely on government benefits like the Canada Pension Plan (CPP) and Old Age Security (OAS), which may not be enough to cover all your expenses.

Employees of The United Church of Canada (UCC) who work an average of 14 or more hours per week, contribute to a Defined Benefit plan.

With the rising cost of living and longer life expectancies, government pensions may not be enough to cover all your retirement expenses. In 2024, the average Canada Pension Plan (CPP) benefit at 65 was $805 per month (with a maximum of $1,364.60), and the maximum Old Age Security (OAS) benefit was $725 per month, rising at age 75 to $800 per month.

Tools and Resources

Check out our pension tools and resources to learn more about:

From the Government of Canada:

Join our webinars on ChurchX to delve deep into retirement planning and your pension plan benefits:

Boundaries Refresher: Retiring with Grace (for ministry personnel only)

As we approach the end of the year, it's the perfect time to reflect on our health and well-being. Teladoc Medical Experts is here to support you with a range of unique medical services designed to provide peace of mind and expert guidance. Stay healthy and informed this December with Teladoc's newsletter.

Expert Medical Opinion

Have you ever felt uncertain about a diagnosis or treatment plan? With Teladoc's Expert Medical Opinion service, you can receive an evaluation of your diagnosis and treatment plan from a carefully selected expert. This ensures you have the confidence and clarity needed to make informed decisions about your health.

Personal Health Navigator

Navigating the healthcare system can be overwhelming. The Personal Health Navigator service empowers you to make informed decisions about your care. Whether you need help understanding your options or connecting to valuable resources, their navigators are there to guide you every step of the way.

Finding a Doctor

Finding the right specialist can be challenging. Teladoc offers access to an extensive network of experts, ensuring you can find the specialist you need in your local area. Their network is designed to connect you with top-tier medical professionals who can address your specific health concerns.

Care Finder

For those seeking specialized care outside of Canada, the Care Finder service is invaluable. With a global database of over 50,000 expert physicians across more than 450 specialties and subspecialties, Teladoc can help you locate the right specialist no matter where you are.

You can access Teladoc Medical Experts by calling 1-877-419-2378 or visiting their website. You'll be connected to a Member Advocate, a Registered Nurse, who will assess your needs and provide the services designed to help you confidently move forward with your care.