February often brings attention to heart health, but it’s also the perfect moment to reflect on the powerful connection between your emotional wellbeing and your physical health. These two parts of your life don’t operate in isolation; they influence each other every day.

When stress, worry, or emotional strain builds up, your body often feels it too. Fatigue, tension, changes in sleep, and shifts in energy can all be signs that your emotional wellbeing needs attention. And the reverse is just as true - when your body feels strong and supported, your mind is better equipped to stay balanced, focused, and resilient.

Healthy Heart & Mind Tips

Your emotional and physical wellbeing are deeply connected. February is a great time to reflect on that relationship and explore what helps you feel more grounded, energized, and well.

Just a reminder, if you want to access your EFAP services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

Website: one.telushealth.com

Username: unitedchurch

Password: eap

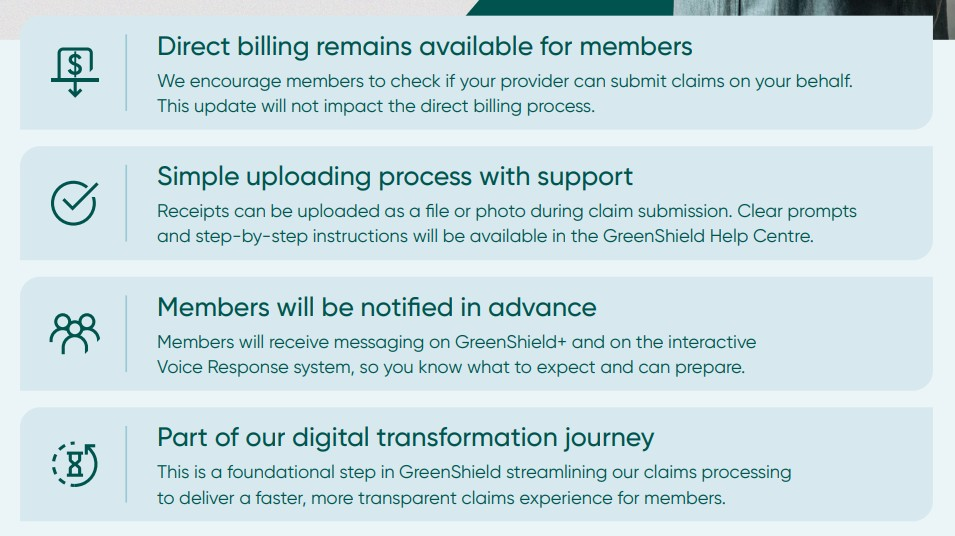

Starting March 4, 2026, GreenShield will be transitioning to mandatory receipt uploads for all claims submitted through GreenShield+. This means rather than keeping receipts for future audits, members will be required to upload it during the claim submission, and GS+ will store it securely*. If you are not already doing so, we recommend adopting this practice now.

*All member data is processed/stored within Canada. They use Toronto-based servers that have been audited to meet the highest standards for data security. This includes multiple on-site and off-site encrypted backups, intrusion prevention and detection systems, and various safeguards.

The Customer Contact Centre is currently experiencing elevated wait times due to a seasonal increase in call volume. To help reduce the impact of these high‑volume periods, several initiatives are underway:

Additional mitigation strategies—including overtime, cross‑functional support, and student staffing—continue to be used to help manage peak‑period demand. These combined efforts are intended to stabilize service levels as call volumes return to normal.

An apology is extended for any inconvenience these delays may cause for members.

Members are encouraged to use their GS+ accounts for self‑service options. You can also find answers to any FAQs through the GS+ Help Centre.

January is the perfect time to reflect on the past year and think about what you’d like to accomplish going forward. You can use this fresh start to evaluate your mental health and set emotional goals that truly works for you and your life.

Why it matters:

Your mental well-being influences every part of your life—from relationships and work to physical health. Setting intentional goals can help you feel more balanced and resilient throughout the year.

Ask yourself:

Even modest, consistent efforts can spark positive change!

Set Your Emotional Goal

Website: one.telushealth.com

Username: unitedchurch

Password: eap

Investing in your mental well-being is a gift that lasts all year. Let this be the season to pause, reflect, and grow with intention because new beginnings deserve renewed minds!

*Just a reminder, if you want to access services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

The holiday season is a time of celebration, but it can also bring added stress and pressure. Between year-end deadlines, family commitments, and financial strain, it’s easy to feel overwhelmed. In December, we’re focusing on two powerful tools to help you navigate the season: gratitude and stress management.

Why Gratitude Matters

Practicing gratitude isn’t just about saying “thank you”—it’s about shifting your perspective. Research shows that gratitude can:

Quick Tip: Start a gratitude list. Each day, write down three things you’re thankful for—big or small. It’s a simple habit that can make a big difference!

Managing Holiday Stress

The holidays can be joyful, but they can also be hectic. Here are a few strategies to keep your stress from sleigh-ing you this season!

The season is about connection and kindness, toward others and yourself, so let’s make space for gratitude and well-being as we close out the year.

Employee and Family Assistance Program (EFAP)

Just a reminder, if you want to access services such as online appointment booking and live chat, you will need to create a personal account. Follow these steps to set up your account.

Website: one.telushealth.com

Username: unitedchurch

Password: eap

As summer winds down, August offers a natural moment to pause, reflect, and reset. Whether you're working toward professional development, project goals, or personal growth, setting intentional goals can help you stay focused and energized.

But goal setting doesn’t have to live in separate silos. In fact, aligning your work goals with your personal wellness goals can lead to greater balance, resilience, and satisfaction, both on and off the job.

Here are a few ways to approach goal setting with wellness in mind:

Reconnect with Your Purpose

What motivates you in your role, and in your life? Aligning your goals with your values and strengths can make your work more meaningful and your personal growth more fulfilling.

Set Clear, Achievable Targets

Break larger objectives into smaller, manageable steps. Whether it’s completing a project or committing to a daily walk, small wins build momentum.

Prioritize Well-Being

Consider how your goals support your mental health, energy levels, and work-life balance. A healthier you is a more focused and productive you.

Stay Flexible

Life and work are dynamic. Give yourself permission to adapt your goals as needed. Progress isn’t always linear.

Celebrate Wins—Big and Small

Recognizing your efforts boosts morale and reinforces positive habits. Take time to acknowledge what you’ve accomplished—professionally and personally.

When you log into your GreenShield+ account, you’ll find a variety of tools and resources on the Well-Being page designed to support your health goals. From interactive activities and mini courses (like improving posture—perfect for those of us at a desk all day!) to a personalized health score that helps you track your progress, it’s all there to help you take small, meaningful steps toward better well-being.

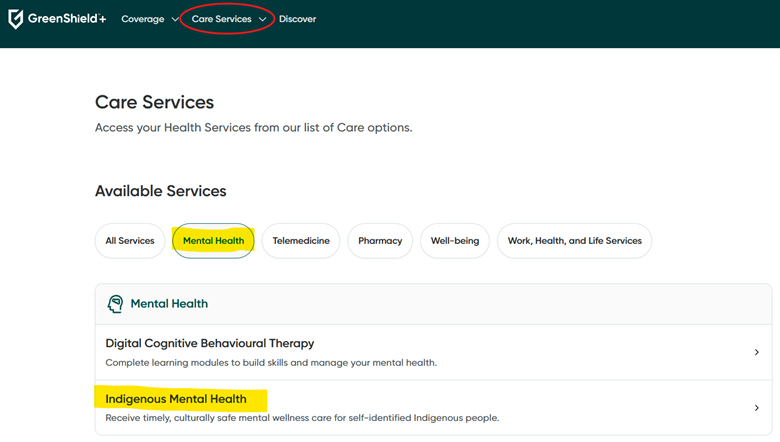

The Benefits Centre is pleased to share information about new services available to Indigenous staff and ministry personnel. These services will provide culturally appropriate support and guidance, ensuring that Indigenous members of the church have access to resources that reflect their own needs and experiences.

Green Shield Canada is partnering with Noojimo Health, an Indigenous-owned organization, to offer culturally safe and timely virtual mental health services. Noojimo Health is the first all-Indigenous virtual mental wellness clinic for Indigenous people. The following services are delivered by Indigenous registered social workers through virtual sessions and phone calls:

The program can be accessed via GreenShield+, under Care Services > Mental Health > Indigenous Mental Health:

These services are available at no cost to members. Some individuals may be eligible to receive up to 22 hours of counselling each year through the Non-Insured Health Benefits (NIHB) program.

Whether it’s stepping away from your desk, reading a book, or setting healthy boundaries in your personal life, self-care is about showing up for yourself in meaningful ways—big and small. This July, we’re celebrating the importance of self-care and friendship, with two key dates to mark on your calendar:

Caring for your whole self is essential to living your healthiest life. This includes your mental, physical, emotional, spiritual, and practical self-care. Here are some examples – with resources from the GreenShield+ Wellness Hub and WorkHealthLife* – on how you can prioritize you.

*Enter The United Church of Canada to gain access to the site.

Mental Self-Care

Physical Self-Care

Emotional Self-Care

Spiritual Self-Care

Practical Self-Care

This month, let’s commit to nurturing ourselves and those around us, because when we care for ourselves, we’re better equipped to care for others.

As we step into June, we embrace a month rich with meaning, reflection, and celebration. It’s a time to honor our differences, uplift voices that have been marginalized, and recommit to building a more equitable, and sustainable world.

This month is a reminder of the importance of diversity in all its forms. It’s a time to reflect on how we can create spaces where everyone feels seen, heard, and valued. Equity is not just a goal—it’s a practice we must embed in our everyday actions and decisions.

Pride 2025

June is also a celebration of the 2S and LGBTQIA+ community’s resilience, creativity, and contributions to society. It’s a time to honor the history of the Pride movement, recognize the ongoing struggles for equality, and stand in solidarity with those advocating for love, dignity, and justice.

World Environment Day

Don’t forget to mark your calendars on June 5 for World Environment Day – a global call to action to protect our planet. This year’s theme emphasizes the urgent need to restore ecosystems and combat climate change. As we celebrate our human diversity, let’s also remember our shared responsibility to care for the Earth, our common home.

Whether it’s attending a Pride event, participating in a sustainability initiative, or learning more about the United Church’s practices (Disability, Accessibility and Inclusion, Gender, Sexuality, and Orientation, and Equity, Accessibility and Privacy) there’s a place for everyone in this journey. Let’s celebrate love in all its forms and continue to push for a world where everyone can live authentically and safely.

Here are a few articles you can check out on GreenShield+:

Feeling stressed about finances? You're not alone. Economic hardships can make managing money feel overwhelming. But there's good news! By assessing your finances and creating a plan to achieve your goals, you can reduce stress and boost your financial wellbeing.

Our Employee and Family Assistance Program (EFAP) provides numerous resources on the WorkHealthLife website. Search "The United Church of Canada" to gain access to articles and resources, such as:

Money and your mind: taking care of your finances and mental health

Financial health: how your finances affect your mind

Millennials: Your financial future is now

Mental Health Awareness Month

May is also Mental Health Awareness Month, a perfect time to focus on your overall wellbeing. Here are some important dates to keep in mind:

Let's make May a month of empowerment and positive change!