As part of GreenShield’s commitment to delivering an exceptional member experience, they will be modernizing their compound policy. This will be implemented in several phases, focusing on specific reimbursement conditions and compound categories. Phase 1 is projected to be implemented on September 3, 2024.

Biosimilar transitioning British Columbia

In May 2019, the British Columbia (B.C.) government implemented a biosimilar switching policy under its public prescription drug insurance plan. In December 2023, BC PharmaCare announced it would provide a six-month transitional period to allow those using Humalog (insulin lispro), used to treat diabetes, with an Omnipod, Ypsomed, Tandem, or Medtronic pump to transition to the biosimilar, Admelog by May 30, 2024. Health Canada has approved Admelog for use with these pumps, and it is a regular PharmaCare benefit. Patients with new approvals for insulin pumps are expected to use Admelog. Details can be found on the BC PharmaCare website.

In accordance with provincial coordination policies, GreenShield will expand their standard Biosimilar Transition Program in British Columbia to include Humalog for those using an Omnipod, Ypsomed, Tandem, or Medtronic pump. Unless an exception applies, the program will transition on July 22, 2024.

GSC have notified plan members that they must transition to Admelog by July 22, 2024. Plan members claiming Humalog and coordinating benefits with the BC PharmaCare Drug Plan will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber for transitioning support, including obtaining a new prescription for Admelog, if necessary. However, if BC PharmaCare grants an exception to allow a plan member to remain on Humalog, GreenShield will follow suit and pay for Humalog to enable continued coordination of claims.

Biosimilar transitioning Quebec

In April 2022, the Government of Quebec implemented a biosimilar switching policy under its public prescription drug insurance plan. On December 12, 2023, Régie de l'assurance maladie du Québec (RAMQ) announced as of December 13, 2023, the biologic Lucentis (ranibizumab), used to treat various eye conditions, will no longer be listed on the List of Medications and RAMQ patients being treated with Lucentis were required to transition to the biosimilar, Byooviz by May 22, 2024. Details can be found on the Infolettre RAMQ (available only in French).

GreenShield will also expand their standard Biosimilar Transition Program in Quebec to include Lucentis. Unless an exception applies, the transition date will be August 22, 2024.

GSC have notified plan members that they must transition to Byooviz by August 22, 2024. Plan members claiming Lucentis (including those coordinating with another drug plan) will receive letters advising them of the upcoming transition. They also recommend consulting with their prescriber or pharmacist for transitioning support, including obtaining a new prescription for Byooviz, if necessary.

Per RAMQ criteria, exemptions will apply to:

If you have any questions, please contact Benefits@united-church.ca

You should have received your 2023 Pension Statement in the mail these last few weeks. If you have not received your statement and are paid through ADP, please contact them directly to ensure the address on file is correct, then contact pension@united-church.ca to request a duplicate statement.

You will notice that your beneficiaries are not shown on your Annual Pension Statement. Please read the insert provided with your statement that explains why your beneficiaries are not listed. You can also read it here.

This is a standard practice in a transition to a new system. As part of the portal launch process, we will require all members to update their beneficiary information for both the pension and benefit plans (as applicable). Rest assured, the beneficiary information that you have previously provided is in place until such time as the new tool is live and you have confirmed your existing designation(s) or have designated new beneficiaries.

If you have any further questions, please email pension@united-church.ca.

Annual member statements for the 2023 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2024. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

| Your Pension | Your Future |

| FOR EVERY YEAR YOU PARTICIPATE IN THE PENSION PLAN YOU INCREASE YOUR RETIREMENT INCOME | $XX,XXX

THE AMOUNT YOU HAVE EARNED ALREADY |

| IN 2023, YOU EARNED

$X,XXX THIS IS ADDED TO THE ANNUAL PENSION YOU’VE ALREADY EARNED |

+ XX,XXX

YOUR PROJECTED ANNUAL PENSION TO AGE 65 |

| + 16,375

MAXIMUM C/QPP BENEFITS (in January 2024) |

|

| + 8,560

MAXIMUM OAS BENEFITS (April to June 2024) |

|

| = $XX,XXX

YOUR TOTAL ANNUAL PENSION EARNED TO DECEMBER 31, 2023 |

= $XX,XXX

YOUR ESTIMATED ANNUAL RETIREMENT INCOME (excluding other employer pensions or personal savings) |

THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue to work in the same job category until you reach age 65. If you stop working before that, or if your pensionable earnings change, this amount will also change.

MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2024 is $9,983.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($90,997, for 2024) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.

GreenShield has advised that their union represented employees have voted in favour of a new, 3-year collective agreement with Green Shield Canada.

The GreenShield contact centre will reopen on Monday, April 22, however, it is anticipated that call volumes may be higher than usual at this time.

GreenShield continues to encourage members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices. For support checking your coverage online, please visit their self-service page.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca

GreenShield's collective agreement with Unifor expired on Friday, March 1, leading to a strike. GreenShield has activated its contingency plan to ensure essential services continue during the strike.

GreenShield remains optimistic that a settlement can be reached through constructive and focused discussions.

Online services, including claim submissions, continue to be available and are not impacted by the Unifor strike, and there will be no interruption to the health and administrative services that GreenShield provides.

The GreenShield contact centre is closed during the strike, but you will still be able to use GreenShield’s online services or their self-serve phone system depending on your needs. Since 94% of claims are submitted online, online service claims continue to be processed; other online services that most members rely on also remain available with minimal disruption.

GreenShield’s self-serve phone system is available via the call centre number, 1-888-711-1119, to:

GreenShield encourages members to use the fully operational online services, including Web, mobile, providerConnect and all real-time submissions from pharmacies and dental offices.

If you have any questions, please email the Benefits Centre at Benefits@united-church.ca

Amid widespread reporting about the risks of artificial general intelligence, Alphabet (formerly Google) shareholders voted on June 2 on a proposal, filed by SHARE on behalf of the Pension Plan of The United Church of Canada, requesting third-party scrutiny of the company’s targeted advertising system.

The proposal calls for the company to undertake a human rights impact assessment and states the growing concerns surrounding Alphabet’s advertising infrastructure’s heavy reliance on technology, including artificial intelligence, which has not been subject to a robust human rights due diligence process. This kind of assessment would identify, address, and prevent the potential adverse human rights impact of targeted advertising technologies.

“Alphabet’s targeted advertising business represents about 80% of the company’s revenue, which means that until a rigorous assessment is done, its shareholders are exposed to a litany of regulatory, legal and reputational risks,” said Sarah Couturier-Tanoh, Associate Director Corporate Engagement and Advocacy at SHARE. “Ultimately, the lack of clear oversight puts investors’ long-term value at risk.”

Proxy advisory firms Glass Lewis and Institutional Shareholder Services, and large U.S.-based pension funds CalPERS, CalSTRS, New York City pension funds, and Norges Bank all agreed with SHARE’s perspective on the matter.

The proposal received 47% support from independent shareholders and 18% overall. The sharp difference between these two figures is explained by the multi-class stock structure conferring 10 votes for 1 share held by Alphabet’s management. SHARE opposes multi-class stock structures as a general principle of good corporate governance.

While our shareholder proposal ultimately did not pass, the nearly 50% support of independent shareholders is a strong signal to Alphabet management that there is great concern about, and now scrutiny of, their targeted advertising system. Often corporate engagement is a process of incremental gains requiring persistence. Persistence is something that the Pension Fund of The United Church of Canada has in abundance when it comes to investing responsibly!

This reminder is a follow-up to notices shared late last year and earlier this year with community of faith treasurers and administrators, as well as ministry personnel, about changes to the regional cost of living group assignments. A copy of the letter shared with treasurers and administrators is in the Downloads section at the bottom of the Ministers’ Salary Schedule and Cost of Living Groups webpage.

These changes will be effective for the pay period beginning July 1, 2023, and apply to the balance of the year. You can find the revised cost of living group assignment data in the Downloads section as well.

If your regional COL group assignment has moved up, your ADP administrator will need to update the minister’s salary in TeamPay or inform ADP of the new salary amount for the pay period beginning July 1.

Salaries for ministry personnel serving in locations where the regional COL group assignment has been adjusted down will be maintained as per the terms of the appointment or call. This includes those whose appointments renew. This means that if the pastoral charge is in a lower cost of living group, the current minister’s salary may not be reduced. It will remain subject to the annual economic adjustment to minimum salaries or as defined in the terms of appointment or call.

There is no change to the COL group for 45 percent of communities of faith. Thirty-nine percent of communities of faith have stepped up one group. Sixteen percent have stepped down one group. These changes reflect regional differences in the costs of housing, property and provincial income taxes, utilities, and goods and services.

The accrual rate is the rate at which you earn your pension. In 2023, you will earn your pension at the rate of 1.85% of your pensionable earnings.

You earn a piece of pension every year that you work and contribute to the plan―like building blocks.

For example, let’s assume that a member’s pensionable earnings stayed constant at $60,000 every year (for easy figuring). From 2019 to 2024, that member would earn:

| Year | Accrual Rate | Formula | Pension Credit Earned |

| 2019 | 1.4% | 1.4% of $60,000 | $ 840 |

| 2020 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2021 | 1.625% | 1.625% of $60,000 | $ 975 |

| 2022 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2023 | 1.85% | 1.85% of $60,000 | $ 1,110 |

| 2024 | 1.4% | 1.4% of $60,000 | $ 840 |

At the end of your career, the annual pension amounts earned each year (pension credits) will add up to the total annual pension you will receive every year for the rest of your life. So, the higher amount earned in 2023 will continue to benefit you for the rest of your retired life.

There is no automatic indexing or increases in our pension plan. Each year, the Pension Board and Pension Plan Advisory Committee assess the resources available and determine whether there are surplus funds that can be used to increase benefits.

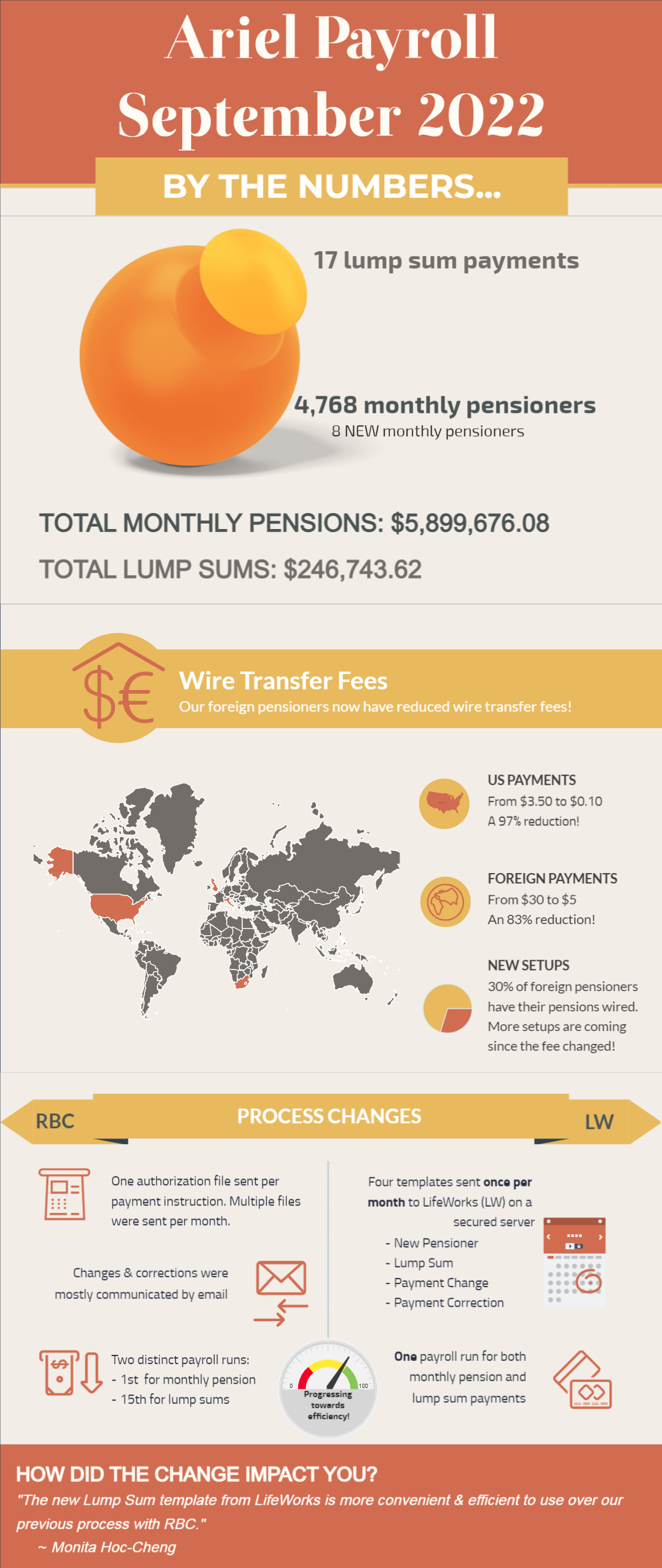

The Benefits Centre team is pleased to announce that we have made 17 lump sum payments and 4,768 regular pension payments following the transition from RBC Investor and Treasury Services to LifeWorks in May. All thanks to LifeWorks' Ariel payroll system that streamlined the payroll run and generated one payroll run instead of two for monthly pensions and lump sums. Check out more details below!

The first letter from the Benefits Centre informing pensioners about the change to the processing of pension payments - from RBC Investor and Treasury Services to LifeWorks.

The second mailing in June was divided into three letters depending on where you are currently residing:

The second communication from the Benefits Centre was mailed the week of June 15, with more information on T4As for the 2022 year, and about the Web portal - which will be available to all in October 2023 but will be optional. Just a reminder, there is nothing for you, as a pensioner, to do on your end.

Three versions of the letter were mailed - depending on your current location - and they are all posted on the Retirement page, under Communications. If you have not received this communication by the end of the month, please e-mail pension@united-church.ca or phone the Benefits Centre at 1-855-647-8222 to ensure they have the correct address on file.

First Mailing - First Letter

Second Mailing -