Annual member statements for the 2024 plan year will be issued to active, deferred, and retired members of the pension plan at the end of June 2025. If you have not received your statement by the first week of July, please contact pension@united-church.ca to ensure the address on file is correct.

Remember that if you have a spouse, they will automatically receive any pre-retirement death benefit as per pension legislation. However, you should also designate a beneficiary in case your spouse predeceases you. If you do not have a spouse and have not designated a beneficiary, your benefit will go to your estate.

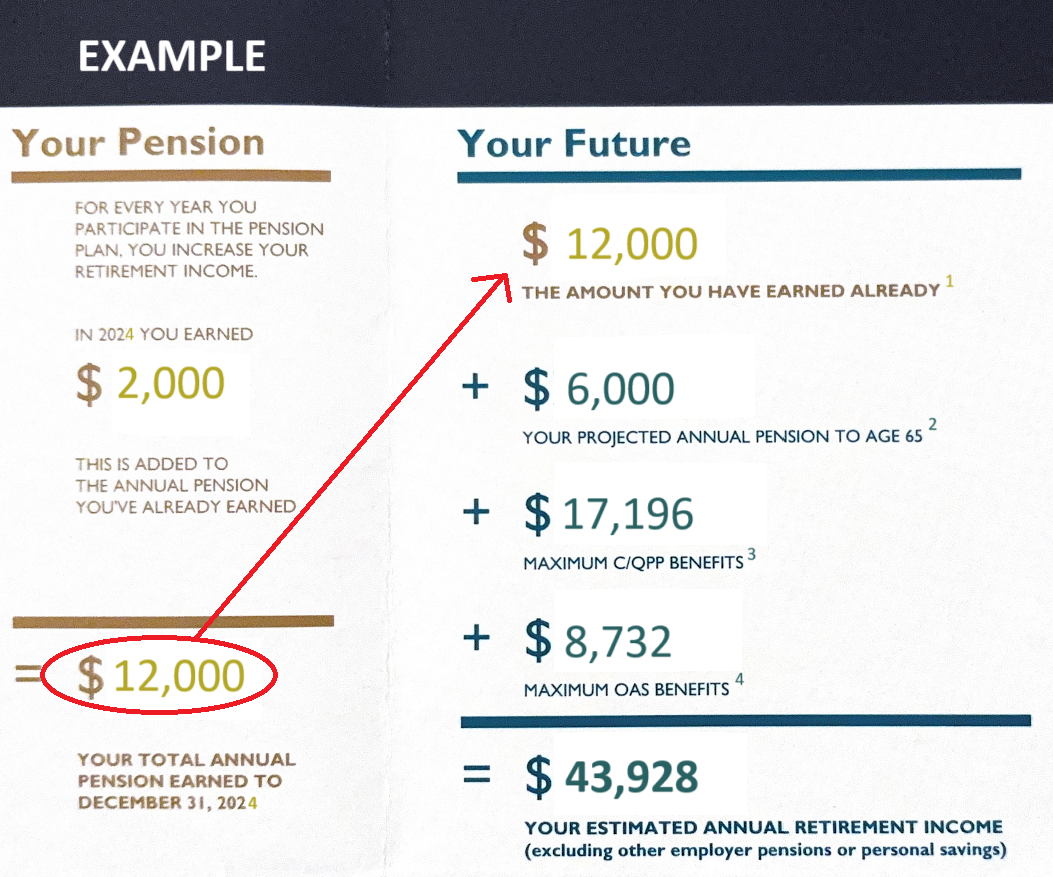

If you have not begun receiving your pension, the statement will contain a box that looks something like this:

1THE AMOUNT YOU HAVE EARNED ALREADY – is calculated based on your pensionable earnings and years of credited service.

2YOUR PROJECTED ANNUAL PENSION TO AGE 65 – is an estimate based on the assumption that you continue working in the same job category until you reach age 65. If you stop working before then, or if your pensionable earnings change, this amount will also change.

3MAXIMUM C/QPP BENEFITS – The amount shown as an example on your pension statement is the maximum amount payable under the Canada Pension Plan. Not all Canadians receive the maximum possible payout from the Canada Pension Plan. Please note that the average annual amount of CPP paid to new recipients (at age 65) in 2025 is $10,796.

To determine your personal benefit under the Canada Pension Plan, you can request a Personal Access Code (PAC). You can use this code to register for My Service Canada Account, which will provide access to your personal record of contributions and benefits earned under the Canada Pension Plan.

4MAXIMUM OAS BENEFITS – Old Age Security is a pension you can receive if you are 65 years of age or older and have lived in Canada for at least 10 years. The amount you receive depends on your income and how long you lived in Canada or specific countries after the age of 18. If your net income exceeds an income threshold ($93,454, for 2025) you will have to repay some or all of your OAS pension.

When planning for retirement, all of these sources of income, as well as your personal savings and any pension from previous employers, should be considered. We recommend that you consult with a financial planner to help with the financial aspects of your retirement planning.